Monetizing Telematics

Charlie Gorman - ETI

- October, 2013

Everyone

knows that vehicle telematics is on its way to be one of the most

significant technologies to hit the automotive industry in a very long

time. And, everyone knows that they need to be involved somehow,

but are not clear what that means. It seems that there is no

shortage of experts who claim to know the end game, but are struggling

to figure out the first steps. The future market for telematics

products is huge and yet everyone currently involved is struggling to

find that magic combination of telematics goodies that makes consumers

line up as if it were a new i-phone. Everyone

knows that vehicle telematics is on its way to be one of the most

significant technologies to hit the automotive industry in a very long

time. And, everyone knows that they need to be involved somehow,

but are not clear what that means. It seems that there is no

shortage of experts who claim to know the end game, but are struggling

to figure out the first steps. The future market for telematics

products is huge and yet everyone currently involved is struggling to

find that magic combination of telematics goodies that makes consumers

line up as if it were a new i-phone.

I have watched presentation after presentation where the speaker

proclaims, with incredible confidence, to know what motorists want, but

then later cannot make a business case for implementation. Either

his or her idea is technically too difficult and expensive to

accomplish, or research has shown that motorists are not willing to pay

for it.

So monetizing telematics has become an important subject in

itself. In some ways it may be the most important topic because

without a free-enterprise engine to power it, telematics is not going

to go anywhere.

When it comes to monetization, many of the articles I have read turn to

the smartphone industry for comparison. This is good because the

similarities are compelling and the smartphone can be a key component

in a vehicle telematics configuration.

Smartphones are devices that form a telematics link between its user

and the services he or she is interested in. It acts as a sensory

device capable of capturing sound, video, global position, motion,

etc. It is an input device capable of gathering information from

other sensory devices. For example, the credit card reader that plugs

into the headphone jack. The smartphone is also an output device

capable of displaying graphics, video and text; producing sounds; and

connecting to other output devices.

Simply having a smartphone in your pocket provides motorists a certain

level of vehicle telematics. Vehicle position, driving

directions, speed, voice communications and every other telematics

functions common to both vehicles and smartphones. Even a vehicle

crash can be detected by a smartphone. A simple app using the

phone’s accelerometer could be used to report potential crashes.

If a phone can do all of this, who needs vehicle

telematics? If a phone can do all of this with free apps,

does it at least partially explain the difficulty everyone in

automotive telematics is having with monetization?

But there is one aspect of vehicle telematics that only the vehicle can

provide. Just like the smartphone, the vehicle is a

computer. But this computer contains hundreds of sensors, modules

and actuators that gather data about the vehicle and implement

commands. Basically the vehicle is an input/output device.

When connected to a diagnostic application either in a smartphone or

any other device capable of remotely connecting to the internet, all of

the vehicle’s diagnostic and maintenance information can become

available to whomever the vehicle owner wants to share it with.

The problem is that vehicle manufacturers only have access to their own

diagnostic information and no one else’s. To what extent are they

willing to provide their customer with a similar telematics experience

that those customers already have with their smartphone usage?

Unlike the smartphone industry, where the consumer can use any brand of

phone they like with apps that work across many platforms, OEMs each

have their own API, so the customer has no guarantee of consistency of

use.

Some vehicle manufactures will not provide connectivity information to

any company that may compete with them in the telematics market and

third-party app developers have little interest in investing time and

resources into apps that can only be used in one brand. Also,

research has shown that in the smart phone market the ratio of free

apps to paid apps is 400:1 with the monetization coming from in-app

advertising, a model which is unlikely to transfer to the auto market

mainly due to safety concerns. The market then, for auto apps other

than navigation, traffic, and audio, is therefore limited.

Thirty percent of customers expect the cost of the connected car should

be included in the overall price of the vehicle, while only a fifth of

those surveyed felt that monthly contracts or a pay-per-use model would

be viable. That isn’t a good sign for the OEM’s profit margins.

So who will pay for telematics?

Vehicle Manufacturers, with a couple of exceptions, are reluctant to

share their own technology. Third-party app developers are unwilling to

expend the effort on something that doesn’t give them a return on

investment. And customers expect telematics to be included in the cost

of their vehicle.

Quoted in an article from Telematics Update, Brian Inouye, National

Manager Advanced Technology, Toyota, puts it this way: “We need a way

to communicate directly with the end user. If the customer wants

to assign their data to a particular establishment then we can enable

that. The customer becomes a happier person. This could be

a differentiator.”

This is an important statement and in my opinion 100% accurate, although probably in a different way than mr. Inouye intended.

Vehicle manufacturers should not worry about telematics except to

provide the simplest, safest and most complete third-party interface to

their vehicles. Of course they will develop their own products

and they will have value for a while, but as the vehicle age’s app

developers in conjunction with systems integrators will develop the

market for the time when these vehicles will need the most service and

maintenance.

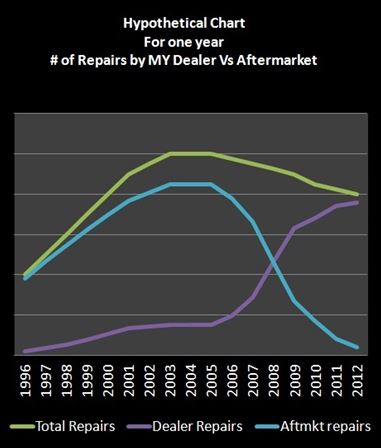

As the chart below suggests, OEMs only have access to the repairs and

maintenance early in a vehicle’s life. Once the vehicle reaches a

certain age, aftermarket service facilities take over the

repairs. It is in the vehicle manufacturer’s best interest to

allow easy access to telematics data in support of third party

telematics solutions, or risk unhappy motorists.

The repairs required for older vehicles are different than the repairs

required on newer vehicles. OE service manuals are updated

through TSBs for a while but once a vehicle reaches a certain age these

TSBs stop coming. Some aftermarket service information providers

base their diagnostics on what is actually happening to older vehicles

as they age. In many cases this makes for better diagnostics. The repairs required for older vehicles are different than the repairs

required on newer vehicles. OE service manuals are updated

through TSBs for a while but once a vehicle reaches a certain age these

TSBs stop coming. Some aftermarket service information providers

base their diagnostics on what is actually happening to older vehicles

as they age. In many cases this makes for better diagnostics.

On board telematics systems have a tendency to become obsolete long

before the vehicle’s transportation value is used up.

Obsolescence, in this case, includes more than complete failure.

It also means being passed up by newer, better, faster

technology. For example, old i-phones still work, but few people

want one. Even if updated software is made available, old

hardware will not be upgraded.

There are other important examples. OEM scan tools become

obsolete at some point. We have seen over and over again where

certain OEM scan tools are no longer made or offered. In these

cases, aftermarket scan tools may be the only solution for these older

cars. The same will probably be true for factory embedded

telematics.

Many multi-brand fleets want to have one telematics solution that

covers all of their vehicle brands. Automakers will never be able

to offer multi-brand solutions.

Ultimately there will be plenty of business for everybody in the

Telematics Market. Motorists will have an interest in proprietary

OEM telematics when the vehicle is young because it will give them

access to warranty and other dealer services, but as the vehicle ages

they will want choice that can only be provided by a third party.

Automakers will still gain because it will create brand loyalty

throughout the life of the vehicle.

Apps

will have to be very low cost or even free. Monetization

will come from service groups, parts chains, service information

providers, equipment companies, etc. providing lead generation to

service facilities within their networks. Motorists will decide

what apps to download based on the affiliation of their favorite

service facility. The more open vehicle manufacturers make their

systems to third party developers, the more likely apps will be

developed and the more favorable their vehicles will be viewed by

customers.

|

|